Hello

In the past week, Oromia Bank has launched a digital fuel payment system dubbed MILKII, while DSTV faces mounting backlash from its Ethiopian users over rising costs and poor service. Meanwhile Kenya is seeking to increase electricity imports from Ethiopia to meet growing demand while Yango signs an EV ownership deal for drivers.

If you are here because someone forwarded you this email, you can subscribe here to get future newsletters.

Oromia Bank Launches Digital Fuel Payment System in Push for Cashless Transactions

Oromia Bank has introduced a new digital fuel payment system aimed at streamlining fuel purchases and promoting the use of cashless transactions across Ethiopia. Read more.

Currency Devaluation, Customer Rage, Layoffs: is DSTV Having a Rough Ride in Ethiopia?

A left-out Champions League broadcast became the breaking point for many Ethiopian DSTV subscribers, triggering backlash over rising costs, content limitations, and unanswered service complaints. Read more.

Kenya Seeks Additional Ethiopian Power Imports to Avert Rationing

Kenya is negotiating an increase in electricity imports from Ethiopia by 50 to 100 megawatts (MW) to address rising domestic demand and avoid potential power rationing, officials at Kenya Power said on Thursday. Read more.

Documents Agency, Ethio-Post Partnership Shakes Up Internet Cafes, Stationery Shops Built Around Old System

A new DARS and Ethio Post partnership is reshaping document services in Addis Ababa, cutting out intermediaries who have established businesses providing contract drafting services to DARS customers. Read more.

Shape the Future of Startup Investment in Ethiopia

Have you ever come across global or continental startup reports on Ethiopia, only to find that the numbers and insights just don’t quite add up?

Often, the reported funding amounts for Ethiopia fail to reflect the true capital flowing into businesses and lack the nuance needed to capture what’s really happening on the ground.

The consequences go far beyond underreporting investments; they risk deterring potential investors by portraying the Ethiopian startup ecosystem as stagnant, ultimately undermining investor confidence and limiting future capital inflows.

At Shega, we’re working to change that.

We are producing a flagship report that captures a more accurate and detailed picture of Ethiopia’s startup investment landscape, among other critical aspects.

And we need your help.

To ensure we don't miss any important deals, we’re inviting innovative business and startup owners/investors to participate in our survey.

Your input is critical to shaping a report that truly represents Ethiopia’s innovation and entrepreneurship scene.

All responses will remain confidential and will only be shared with your consent.

👉 [Take the Survey]

Thank you for helping us create a stronger, more connected ecosystem.

Ethiopia Set to Legalize Foreign Ownership of Real Estate, Pending Parliamentary Approval

A landmark piece of legislation that could allow foreigners to own real estate in Ethiopia has received unanimous approval from the Council of Ministers. Read more.

Ethiopian Software Company Bets On Rent-to-Use SaaS Model with Monthly Subscriptions Starting at 5,000 ETB

Can you rent software in Ethiopia? Yonet Systems, a local software startup, looks to introduce a SaaS model starting at just 5,000 birr/month, built for Ethiopian SMEs. Read more

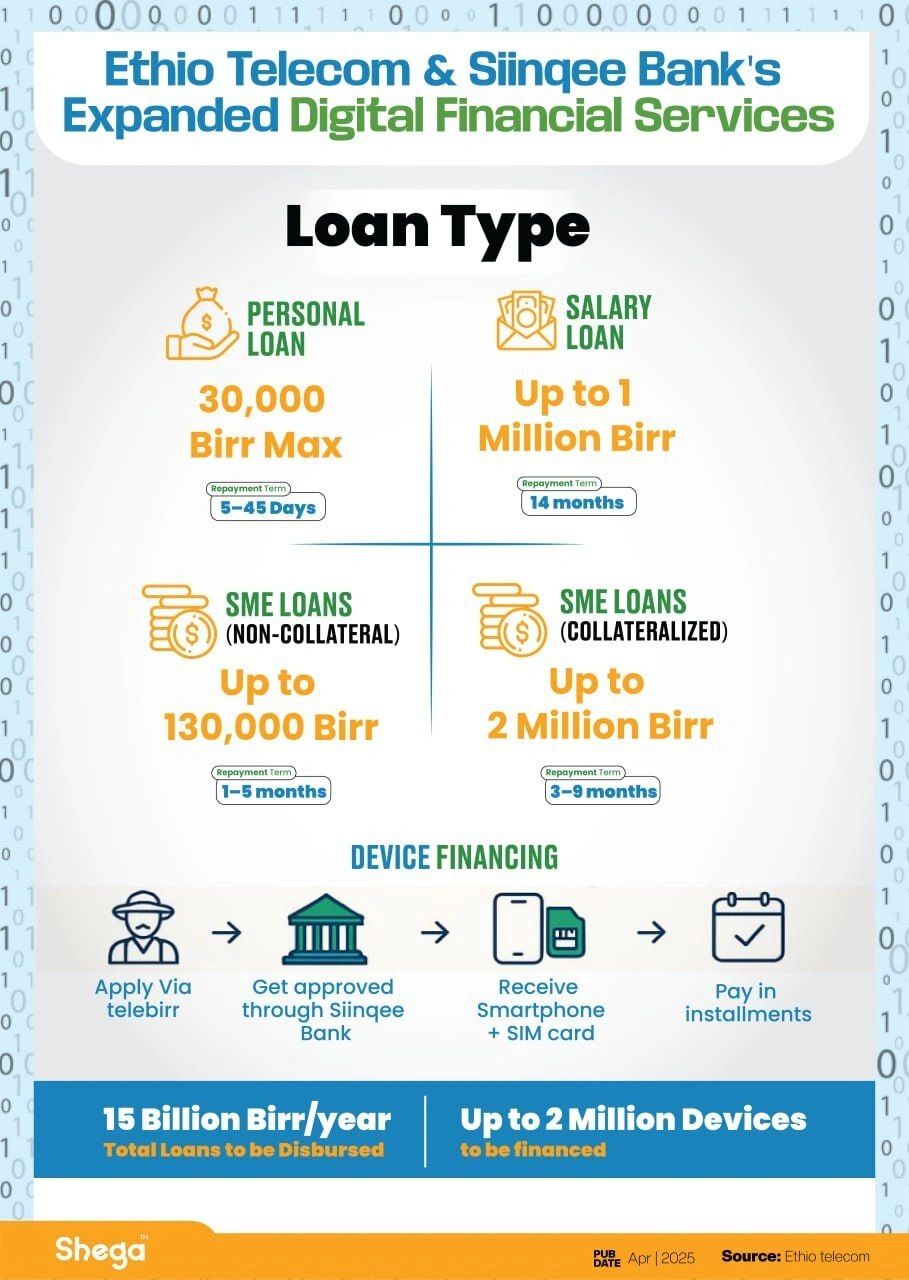

𝗗𝗶𝗴𝗶𝘁𝗮𝗹 𝗟𝗼𝗮𝗻𝘀 𝗶𝗻 𝗘𝘁𝗵𝗶𝗼𝗽𝗶𝗮 𝗔𝗿𝗲 𝗡𝗼 𝗟𝗼𝗻𝗴𝗲𝗿 𝗠𝗶𝗰𝗿𝗼

Over the past three years, over a dozen digital lending platforms have entered the market in Ethiopia. However, their portfolios have largely remained unchanged, with only a few exceptions.

Credit caps have stagnated at the levels set during their initial launch, and most digital lending products are tailored for personal use or salaried employees.

Now, a bold shift is underway, led by a new bank that emerged from a micro-finance institution. Last week, Siinqee Bank and Ethio telecom launched a range of digital financial services through telebirr, offering personal loans of up to 30,000 birr, non-collateral business loans of up to 130,000 birr, and collateral-backed loans reaching as high as 2 million birr.

In addition, the device financing service, which includes the provision of SIM cards alongside smartphone financing, is one of the new offerings launched by the two partners.

Yango Signs Deal to Help Drivers Own Electric Vehicles

Yango Ethiopia has signed a Memorandum of Understanding (MoU) with Amigos Saving & Credit Cooperative Society to support its partner drivers in purchasing electric vehicles (EVs). Read more.

$1M Immunization Fund Opens for Innovators Tackling Zero-Dose Challenge in Ethiopia, Nigeria

Save the Children readies for second round of applications for its $1 million accelerator program supporting up to seven innovative solutions from Ethiopia and Nigeria targeting 'Zero Dose' children. Read more.

Askari Metals Secures Five Gold Licences in Ethiopias Untapped Adola Belt

Askari Metals has acquired 100pc of Rift Valley Metals, gaining five gold exploration licences covering 460sqkm in Ethiopia’s Adola Greenstone Belt, part of the southern Arabian-Nubian Shield, a mineral-rich but underexplored region. Read more.