Top Stories of the Week

Foreign Banks to Enter Ethiopia’s Financial Market by 2025

A2SV Founder Emre Varol Detained at Addis Ababa Airport

Huajian Group Pivots to EV Assembly as AGOA Suspension Hits Textile Export Business

Ethiopian Telecommunications Trailblazer on Trial

Digital Nomads: This Ethiopian-Born 6x Founder Is Building a Web3 Game to Connect With Her Roots

At Shega, we are not just a media company. We equip businesses, organizations, investors, and policymakers with the tools they need to make informed decisions.

If you're looking to elevate your communication and marketing or tap into our insights, market research, and advisory services, we’re here to help.

Foreign Banks to Enter Ethiopia’s Financial Market by 2025

National Bank of Ethiopia Governor Mamo Mihretu announced that foreign banks will begin operations in Ethiopia before the end of the year.

Speaking at the Ethiopian Finance Forum, he highlighted this as a major policy shift aimed at liberalizing the financial sector.

While he did not name specific banks, Mamo confirmed that necessary preparations have been completed. Read more.

Ethiopia Integrates Fuel, Fares, and Fines in Sweeping Digital Reform

Ethiopia launched a national digital transport platform integrating intercity buses, ticketing, fuel payments, and penalties. The platform is developed by Ethio telecom and the Transport Ministry. Read more.

A2SV Founder Emre Varol Detained at Addis Ababa Airport

Emre Varol, founder of A2SV, was detained last week at Addis Ababa airport and was barred from leaving Ethiopia.

Emre, who took the matter to social media, shared a photo of the legal order, which alleged that he was a suspect in a criminal case and was barred from leaving the country until his case appeared in court.

A Turkish citizen and U.S. resident, Emre has spent years building a tech talent pipeline, training 800 engineers—600 from Ethiopia—with $4M in backing.

Despite global success, he faces financial strain due to funding delays.

Emre has previously stated that he plans to close his offices in the Ethiopian capital and relocate to Kigali, Rwanda.

The decision to terminate the six-year-long stay follows a protracted financial dispute with Abrehot Library over unpaid rent and a reported lack of “support”, according to founder Emre Varol. Read more.

What’s on Our Mind

Ethiopia’s central bank governor Mamo Mihretu said last week that direct borrowing to the government has dropped to zero. The ambience at the Ethiopia Finance Forum was marked by a distinct air of pending liberalization and a shift to international best practices. A new playbook for Ethiopia’s finance architecture appears to have been rolled out.

As the country wholeheartedly embraces recommendations seemingly from the policy cocktail of Bretton Woods institutions, it might prove wise to tailor them to the country’s unique context. While inflation has cooled off under the Governor’s tight monetary policies, the rapid decline in the Birr’s value and gradual removal of energy subsidies have ushered in unprecedented pressures on most households. The effective freeze on capital projects outside the capital has decelerated the growth of sectors like construction, which have historically been the second-highest source of employment.

As the Federal government weans off its reliance on central bank financing, it has increasingly tapped into the pockets of domestic borrowers, occasionally with legislative authority. One test of genuine fiscal health might be the payback date for the five-year treasury bills and bonds doled out over the past few years. Nevertheless, the most consequential complementary move by the government for the central bank’s prudential financing could be strategic budget prioritization. Projects with less pazazz and more earthy aspirations might prove economically and politically fruitful.

Ethiopian Investment Holdings Invests 7 Billion Birr in Treasury Bills

Ethiopian Investment Holdings has entered the Treasury Bill market with a 7 billion birr investment, marking its first participation in the National Bank of Ethiopia’s auction.

The initiative is part of an ongoing effort to strengthen the primary debt market by diversifying the investor base and supporting the government's strategy to mobilize domestic resources through market-based instruments. Read more.

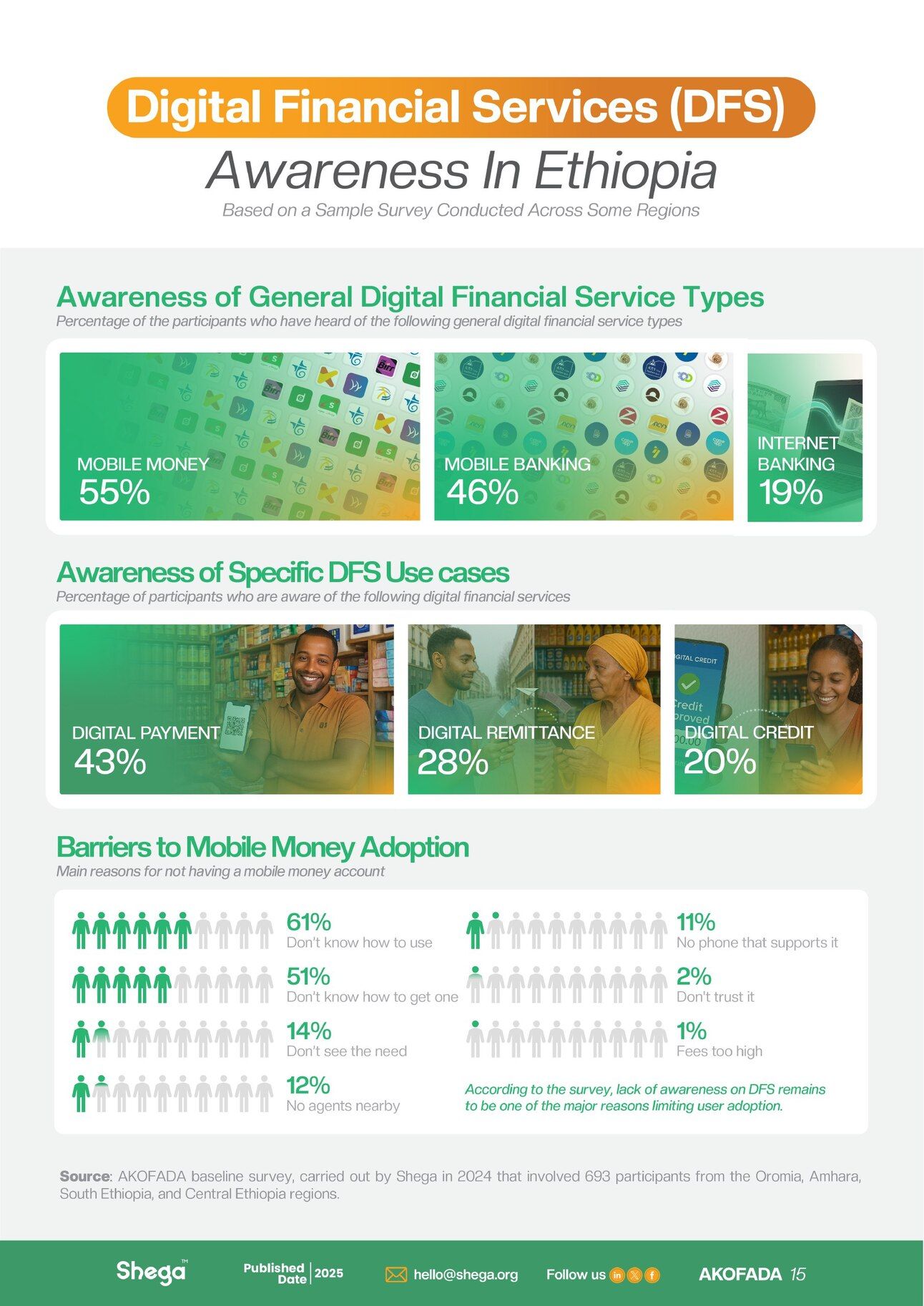

Digital Financial Services (DFS) Awareness in Ethiopia

Digital financial services (DFS) are experiencing growing adoption across Ethiopia; however, awareness and usage levels remain uneven across the various digital channels available.

Explore the detailed visual under AKOFADA (Advancing Knowledge on Financial Accessibility and DFS Adoption), our initiative to support informed decision-making in digital finance.

Visit DFS Ethiopia Hub to download the high-resolution visual.

Revenue Bureau Cracks Down on Alleged Tax Evaders

The Addis Ababa Revenue Bureau introduced a debt tracking system that would trace tax evaders. As a result, five vehicles were seized and sold to recover tax debts, generating 10.9 million Br. Currently, 13 additional vehicles and one residential property are in the process of being auctioned. Read more.

Huajian Group Pivots to EV Assembly as AGOA Suspension Hits Textile Export Business

China’s Huajian Group is gearing up to establish an electric vehicle (EV) assembly facility within the Eastern Industrial Zone (EIZ) in Dukem.

The company has already begun importing EVs, and plans are in motion to initiate semi-knocked down (SKD) assembly operations by next year.

This move into the automotive sector marks a surprising pivot for Huajian, which had previously focused solely on footwear and textile production in Ethiopia.

Its operations were severely affected by the COVID-19 pandemic and the U.S. government’s suspension of Ethiopia from the African Growth and Opportunity Act (AGOA) in late 2021. Read more.

Ethiopian Securities Exchange and IFC Launch Money Market Capacity Building Project

The Ethiopian Securities Exchange (ESX) and the International Finance Corporation (IFC) have signed an agreement to initiate the Ethiopia Money Market Capacity Building Project. Read more.

Ethiopian Telecommunications Trailblazer on Trial

A high-stakes criminal tax case has resulted in the incarceration of an Ethiopian-American tech CEO behind one of the first private internet service provider licenses in the country.

Dawit Birhanu, CEO and co-founder of WebSprix IT Solutions Pvt. Ltd has been imprisoned for the past five months.

Websprix, a company with significant shares owned by Ethiopian diaspora, has provided a range of internet and technology services in Ethiopia for the past fourteen years, employing over 400 people. Read more.

How Brands Might Have Paid for Your Latest Recommendation from AI

Brands might now pay thousands per month to be “the best answer” inside ChatGPT or Perplexity. This isn’t a Google ad. It’s a company being named by AI as the top choice. Welcome to the era where AI answers can be engineered and credibility manufactured. Read more.

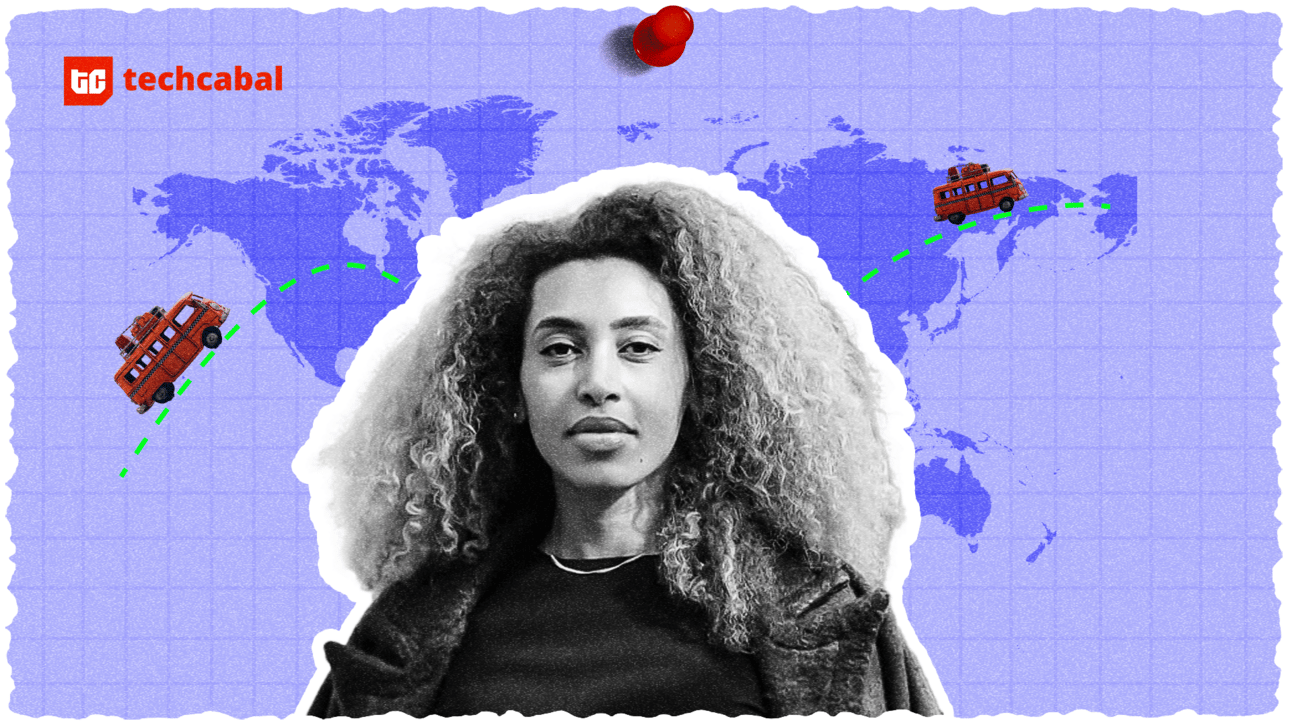

Digital Nomads: This Ethiopian-Born 6x Founder Is Building a Web3 Game to Connect With Her Roots

Ethiopian-born entrepreneur Kanessa Muluneh, now based in Dubai, launched Rise of Fearless, a Web3-based peer-to-peer battle royale game, on May 3.

Inspired by Ethiopia’s Battle of Adwa, the mobile game aims to attract African gamers with historical storytelling, local weapons, and play-to-earn features, including NFTs.

Muluneh, a 6x founder who sold a medtech firm at 21, is now raising $700,000 to scale the game.

Despite initial bugs and graphics issues, a recent tournament spiked downloads to over 1,000. The game targets 100,000 users in year one, with monetization through ads and NFTs, and ambitions of becoming a billion-dollar African title. Read more.

How Ethiopia’s Gamble on Green Mobility is Quietly Driving Gas-Powered Cars Off the Road

Once in demand, gas-powered cars are now struggling to sell in Ethiopia. A bold national push for electric vehicles is quietly replacing the rumbling engine with the hum of an electric motor. Read more.

Digital P2P Lending Platform for Ethiopia

What if borrowers and lenders could connect directly through a simple and innovative way? A Digital P2P Lending Platform could be the answer for this.

Shega’s AKOFADA project latest report explores the design and applicability of a safe and seamless platform for connecting borrowers and lenders.