Top Stories of the Week

State to Impose Series of Taxes on Fuel and Vehicles

Government Bonds Set to Debut on Securities Exchange Next Month

A Halal Path to Ethiopia's Financial Inclusion

KCB Group Opens Talks to Enter Ethiopia's Banking Sector

Why Most Ethiopians Abroad Still Avoid Banks to Send Money Home?

At Shega, we are not just a media company. We equip businesses, organizations, investors, and policymakers with the tools they need to make informed decisions.

If you're looking to elevate your communication and marketing or tap into our insights, market research, and advisory services, we’re here to help.

State to Impose Series of Taxes on Fuel and Vehicles

The federal government is set to implement a series of new taxes targeting fuel and fuel-powered vehicles as part of efforts to boost public revenue.

The measures include a 15% value-added tax (VAT) and a 15% excise duty on fuel, alongside a new vehicle circulation tax specifically applied to fuel-powered cars. Officials describe the tax package as essential for creating a more efficient and sustainable fiscal structure.

These moves follow a broader shift in Ethiopia's fuel pricing strategy. Since mid-2022, the government has been phasing out longstanding fuel subsidies to curb public spending and minimize distortions in the energy market

Many, including opposition figures, have been quick to criticize the plan, accusing the administration of further burdening consumers already struggling with inflation and high living costs. Read more.

Rammis Bank Commences Mobile Application, Card Banking Services

Rammis Bank has launched its mobile banking application and card services as part of its digital expansion drive. The app allows users to transfer funds, pay bills, top up mobile airtime, and send money to telebirr wallets for themselves or others. Read more.

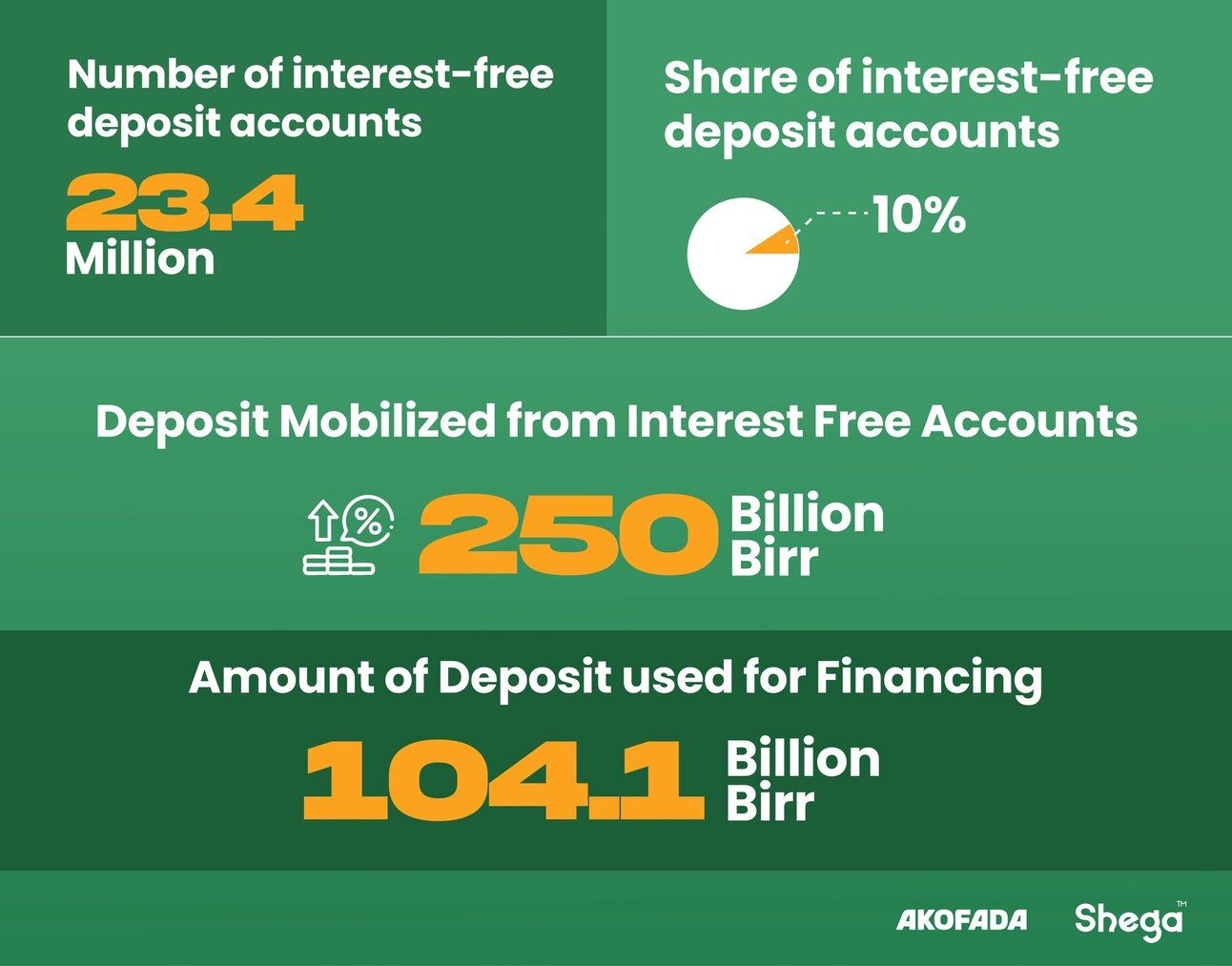

A Halal Path to Ethiopia's Financial Inclusion

Ethiopia’s digital financial revolution risks deepening exclusion, unless interest-free financial services are brought into the picture.

Despite strong deposit growth, only a handful of interest-free banks offer real digital financing services. Platforms like Halalpay and Ansar are innovating, but they’re the exception.

BNPL has emerged as the most viable digital financing model, but scaling it nationally requires more than product design; it demands clear regulation, investment in infrastructure, and a Sharia-compliant innovation ecosystem.

However, for millions of Ethiopians seeking interest-free digital options, the offerings are few and fragmented.

Insights Powered by Project AKOFADA. Read More.

What’s on Our Mind

Ethiopia is poised to ratify a historic 1.93 trillion Birr federal budget for the coming fiscal year, an increase of roughly 32% over the previous cycle. Yet beyond the headline figure lies a more consequential shift: the government’s intensifying reliance on domestic revenues to fund its operations.

According to the draft presented to parliament by Finance Minister Ahmed Shide, the federal government aims to collect approximately 1.1 trillion Birr in taxes. The plan hinges on a combination of new levies and a broadening of the tax base, with notable emphasis on Value Added Tax (VAT), excise taxes on fuel, and a motor vehicle circulation tax targeting fuel-powered cars. Even traditionally exempt goods such as sugar and salt are slated for taxation in the year ahead.

This recalibration reflects a deeper fiscal realignment. In a bid to curtail direct borrowing from the National Bank, the government intends to rely exclusively on domestic debt to close the budget gap. Still, nearly 29% of total expenditures are earmarked for debt servicing, a sobering indication that repayment obligations continue to shape fiscal priorities.

Minister Ahmed was clear: no new major capital projects are expected in the year ahead.

The aggressive pursuit of new tax revenues, in an environment already marked by double-digit inflation, a weakening Birr, and stagnant wages, risk pushing households closer to the edge. What little disposable income remains for many Ethiopians may be further eroded, deepening economic anxiety.

This pain may be exacerbated by shortcomings within the Revenue Ministry, frequently criticized for inefficiency and unprofessional conduct.

For tax reform to succeed, it can’t be measured solely in terms of how much is collected. Convenience, predictability, and equity must become central objectives. The government’s fiscal ambitions may be justified, even necessary, but without attention to the experience of the taxpayer, they risk breeding resentment rather than resilience.

KCB Group Opens Talks to Enter Ethiopia's Banking Sector

Kenyan banking giant KCB Bank Group has officially initiated negotiations with the National Bank of Ethiopia (NBE) to explore entry into Ethiopia’s banking sector. If successful, KCB may either obtain a banking license to establish a local subsidiary or acquire equity in an existing Ethiopian bank.

This move marks a renewed effort by KCB, which has maintained an office in Ethiopia since 2015 and previously sought entry in 2019. The shift in Ethiopia’s regulatory environment, spurred by liberalization reforms, has opened the door to international banking players. Read more.

This Ethiopian App Integrates Traditional Healers into Digital Health Platform

A new telehealth app in Ethiopia is bringing doctors, therapists, and licensed traditional healers into the digital health ecosystem. Tena'Adam looks to bridge gaps in the country's health sector by providing specialized care for rural and semi-urban areas. Read more.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Government Bonds Set to Debut on Securities Exchange Next Month

The Ethiopian government will begin issuing Treasury bonds on the Ethiopian Securities Exchange (ESX) next month, allowing public participation in government financing through a regulated market platform.

This initiative represents a major milestone in the modernization of short-term treasury instruments and aims to mobilize funds for infrastructure development while expanding participation in the domestic capital market.

According to Tilahun Kassahun (PhD), CEO of the Exchange , the new investment window especially targets members of the diaspora and foreign investors.

The current market for treasury bills and bonds is substantial. As of June 2024, the total outstanding T-bills reached 447.8 billion Birr, while the total outstanding T-bonds reached 99.2 billion Birr. Read more.

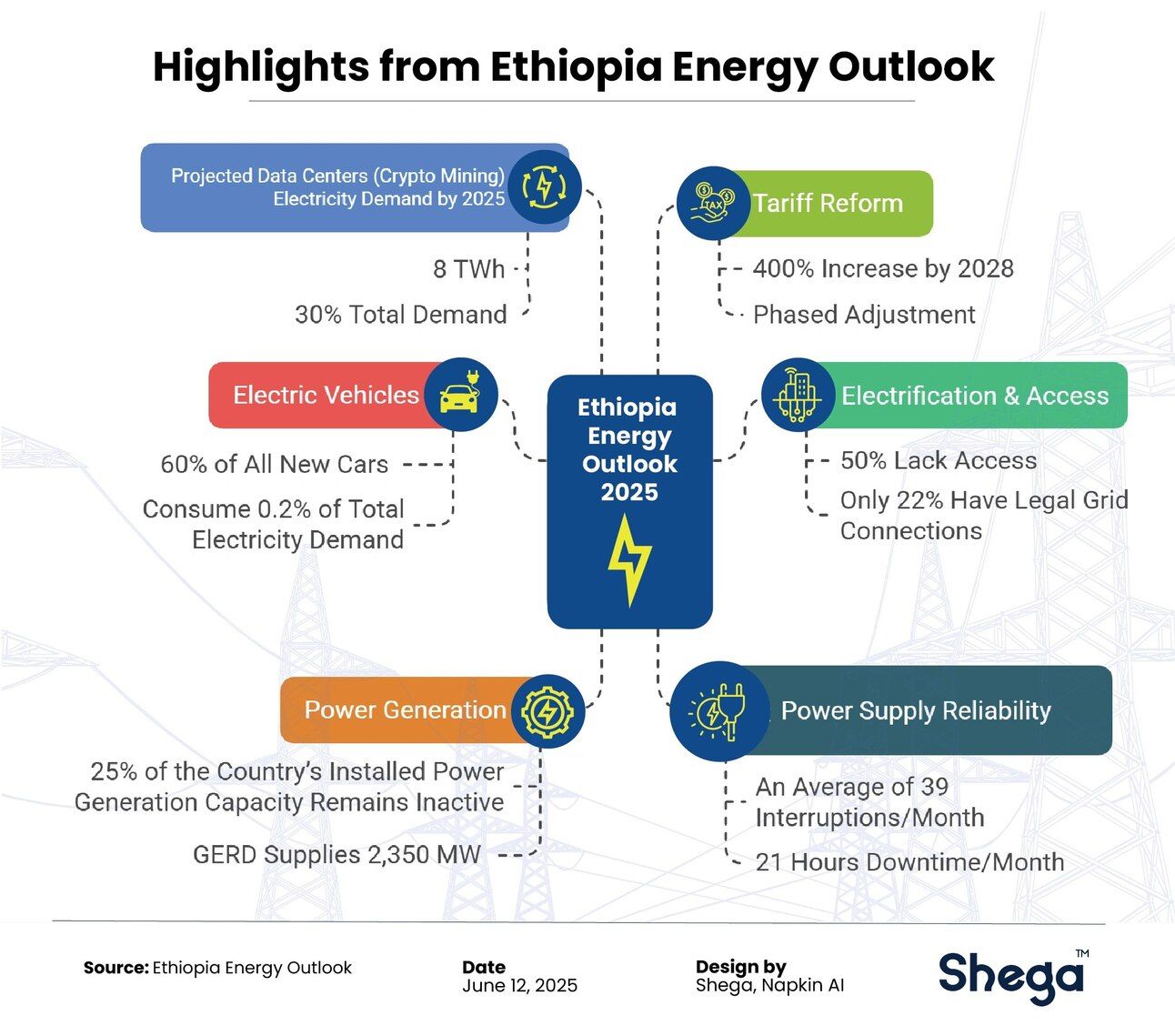

The second Ethiopia Energy Outlook, published by the Ministry of Water and Energy, EEP, EEU, and PEA, offers a snapshot of a sector caught between ambition and constraint. Despite near-complete reliance on hydropower and the commissioning of turbines at the Grand Ethiopian Renaissance Dam (GERD), electricity remains out of reach for nearly half of the population.

The report highlights ongoing reforms, including a shift to a market-driven exchange rate and a phased 400% tariff increase through 2028, aimed at making the electricity supply commercially viable. As electricity exports and demand from EVs and data centers grow, the Outlook stresses the urgent need for grid expansion, targeted private capital, and cautious tariff reforms to balance affordability with long-term energy goals.

Why Most Ethiopians Abroad Still Avoid Banks to Send Money Home?

Migration isn’t just about movement; it's also about money. For hundreds of thousands of undocumented Ethiopians abroad, sending money home through formal channels isn't just costly, it's risky.

Remittances make up about 5% of Ethiopia’s GDP and are a vital source of foreign currency, yet most of this capital may not touch the formal financial system. High fees, low trust, tax fears, immigration status, and primarily price differences between official and parallel markets drive the flow.

Without reform, billions will keep flowing through invisible pipelines. Despite floating the Birr, Ethiopia’s formal remittance system remains underutilized and underdeveloped. Read more.

Ethiopia’s Digital Bureaucracy Faces Reality Check as EU-Funded BEIC Project Wraps Up

EU-funded €7.2M BEIC project formally concludes, having digitized core public services and created platforms to streamline bureaucratic bottlenecks.

Implemented by GIZ and McKinsey, the Project has trained 1,200+ civil servants and supported millions of online processes. But the flagship digital platform for business registration remains stalled amid pending security clearance. Read more.

$1.8 Billion Africa’s Gaming Market Is Expanding Beyond Traditional Giants

A new industry report shows Africa’s gaming sector is soaring beyond dominant markets such as South Africa and Nigeria, with emerging hubs like Eritrea and Niger leading in revenue growth.

Africa’s gaming boom is no longer limited to its largest economies. Rising mobile penetration and a growing tech-savvy population are driving the emergence of unexpected gaming hubs.

The report, an annual statistical analysis from Carry1st, a Web3 gaming publisher, and Newzoo, a provider of PC and console games market data and insights, reveals that Africa’s gaming market is growing six times faster than the global average.

“The dominance of mobile gaming, making up nearly 90% of the market, highlights the distinct path Africa is taking—leapfrogging traditional platforms. With such growth in players and spending, it’s clear that Africa is one of the few places to find secular growth in an industry that is otherwise showing signs of maturity.” Read more.

The Integration of Digital Financial Services in PSNP Programs - Analysis of Ethiopia's Rural PSNP

Explore how Ethiopia’s Productive Safety Net Program (PSNP) is embracing digital financial services to improve payment delivery, boost financial inclusion, and enhance transparency.

This report highlights how DFS is enabling faster, more transparent, and inclusive payments for millions of low-income households, while supporting national goals for financial inclusion.