Top Stories of the Week

Addis Ababa Tables 350 Billion Birr Budget Plan for Upcoming Fiscal Year

Beemi Raises $1 Million to Scale Ethiopia’s First Gamified Livestreaming Platform Across Africa

Chinese EV Maker Neta's Parent Company Enters Bankruptcy

Crackdown on Non-Compliant Universities: 57 Sanctioned

BirrLink Receives Payment Gateway License from National Bank of Ethiopia

At Shega, we are not just a media company. We equip businesses, organizations, investors, and policymakers with the tools they need to make informed decisions.

If you're looking to elevate your communication and marketing or tap into our insights, market research, and advisory services, we’re here to help.

Addis Ababa Tables 350 Billion Birr Budget Plan for Upcoming Fiscal Year

The City Administration has approved a resolution to submit a proposed budget of 350 billion Birr for the 2025/26 fiscal year to the City Council for deliberation.

According to the Administration’s statement on its official social media page, the draft budget is designed with a central focus on poverty reduction, encompassing targeted subsidies for sustainable development, investment in large-scale job-creating projects, and enhanced service delivery to address the growing demands of the residents. Read more.

Enat Bank Disburses 1.4 Billion Birr in Collateral-Free Loans to Women Entrepreneurs in Ethiopia

Enat Bank disbursed over 1.4 billion Birr in collateral-free loans to nearly 22,000 women through its Malefiya digital credit platform powered by AI-based credit scoring from Kifiya’s Qena system. Read more.

Beemi Raises $1 Million to Scale Ethiopia’s First Gamified Livestreaming Platform Across Africa

Beemi, Ethiopia’s first gamified livestreaming platform which transforms streams into interactive experiences and real-time storefronts, raised $1M in a seed funding round as it scales across Africa.

Investors include Antler, Vibe Capital, Renew Capital, NaiBAN, and sector-focused angels. Beemi allows live streamers on TikTok, YouTube, and Twitch to integrate interactive elements like games, polls, and real-time purchases. Read more.

What’s on Our Mind

A Numbeo report last week which ranked Ethiopia as the most expensive country to live in Africa was a hot headline in several local publications. The high cost of groceries apparently swallows the bulk of the disposable income in most fixed income households. Double-digit inflation, driven by rising energy prices, a weakening currency, and chronically low food production, has eroded purchasing power over the past few years.

Although austerity measures by the central bank have helped bring inflation down by more than 10 percentage points in two years, many Ethiopians are still struggling to quiet their rumbling stomachs. Everyday staples such as eggs, milk, and even traditional grains like teff are increasingly becoming luxuries reserved for affluent households.

Perhaps most concerning is that the trend shows no signs of reversing. As the federal government deepens its fiscal consolidation efforts, aimed at increasing revenues and cutting expenditures, the cost of living is likely to rise even further.

The most consequential policy shift involves the phased removal of fuel subsidies, a process that has been unfolding over the past four years. Starting next month, domestic fuel prices will be fully aligned with international markets, potentially increasing prices by as much as 20 percent per liter. This follows an already staggering 280 percent increase in the price of benzene during the subsidy phase-out period.

With wages largely stagnant and a raft of new taxes further reducing disposable income, many Ethiopians may face even harsher winters in the months ahead. Striking a balance between appeasing international lenders and addressing the lived realities of citizens may prove both politically prudent and economically necessary for the current administration.

Ethiopia Slashes Capital Thresholds for Foreign Investors

The Ethiopian Investment Board has lowered the capital requirements for foreign investors seeking to enter previously restricted sectors such as the export, import, wholesale, and retail trades by more than half, revising a directive issued less than eighteen months ago.

The amended directive, effective June 12, 2025, signals a recalibration of the country’s investment strategy amid slowing foreign capital inflows and rising calls for equitable treatment of local and international players. Read more.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Chinese EV Maker Neta's Parent Company Enters Bankruptcy

Zhejiang Hozon New Energy Automobile, the parent company of the electric vehicle (EV) brand Neta, has entered bankruptcy proceedings.

The move, which took effect on 19th June, signals significant financial difficulties for the Chinese carmaker. Adding to the woes, several Neta showrooms in Shanghai have reportedly closed their doors.

Ethiopian Developer Launches a Centralized Portal for Ad Placements on Telegram

Ethiopian developer launched Kelemat Ads, a portal that connects businesses with Telegram channels through a searchable portal, offering ad booking, automation, and payment via Telebirr. Read more.

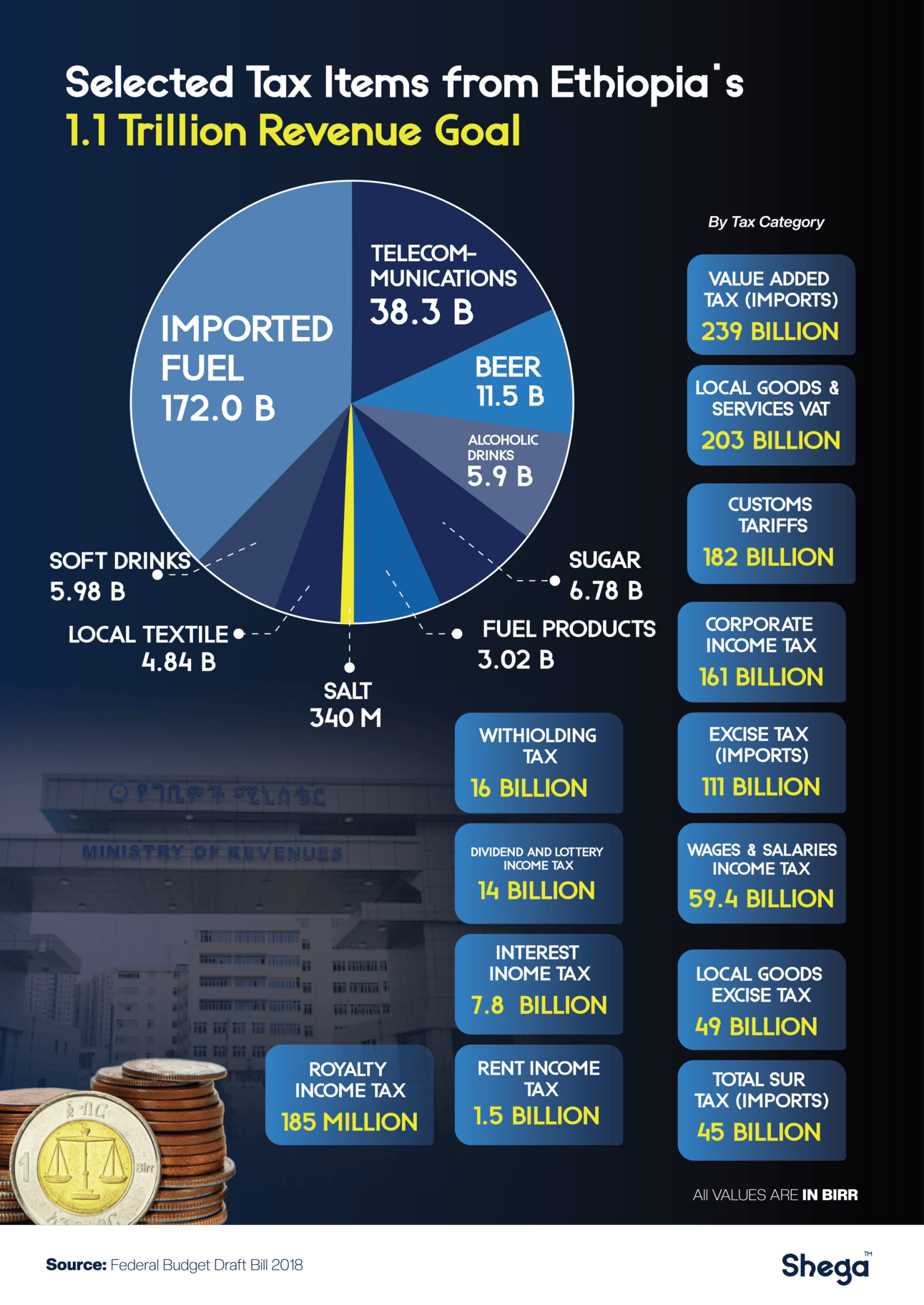

Ethiopia is poised to ratify a historic 1.93 trillion Birr federal budget for the coming fiscal year, an increase of roughly 32% over the previous cycle. Yet beyond the headline figure lies a more consequential shift: the federal government’s intensifying reliance on domestic revenues to fund its operations.

Almost 73% of the revenue will be sourced from taxes as the government weans itself off from direct borrowing from the central bank. The plan hinges on a combination of new levies and a broadening of the tax base, with notable emphasis on Value Added Tax (VAT) and excise taxes.

Somalia’s First Stock Exchange Goes Live

For the first time in its modern history, Somalia now has a stock exchange. On June 19, 2025, the country officially launched the National Securities Exchange of Somalia (NSES) in Mogadishu.

The NSES will begin trading in early 2026 with a focus on stocks and sukuk (Islamic bonds). It’s been backed by the Somali Ministry of Finance and the Central Bank, with a mission to help local businesses raise capital, offer new investment channels to citizens and the diaspora, and finally pull Somalia into East Africa’s growing capital markets. Read more.

Crackdown on Non-Compliant Universities: 57 Sanctioned

The Federal Education & Training Authority has sanctioned 57 higher education institutions across 89 campuses for failing to meet regulatory standards.

According to Deputy Director General Beniam, the violations include forged academic certificates, admitting students below national cut-off scores, missing Competency (COC) exam results, and expired licences. Read more.

EU Backs €8 Million Sub-Saharan Arts Program Eyeing Cultural Pact, Creative Ties

Connect & Create, an €8 million EU-backed cultural initiative, will offer grants, mobility funding, and institutional support to artists and cultural professionals across Sub-Saharan Africa. Read more.

BirrLink Receives Payment Gateway License from National Bank of Ethiopia

After over a decade in digitization, reengineering and BPO services, Faris Technologies is leveraging its institutional experience to launch a new payment gateway operator under subsidiary BirrLink.

Since 2021, Ethiopia’s payment gateway licensing framework has seen a surge in entrants, but not all have thrived. While firms like SantimPay reported 86 million Birr in profits and launched remittance services, others like Sunpay have seen licenses revoked.

BirrLink, entering with 3 million Birr in paid-up capital, aims to differentiate through targeted innovation, multilingual functionality, and a focus on untapped market segments. Read more.

Digital P2P Lending Platform for Ethiopia

What if borrowers and lenders could connect directly through a simple and innovative way? A Digital P2P Lending Platform could be the answer for this.

Shega’s AKOFADA project latest report explores the design and applicability of a safe and seamless platform for connecting borrowers and lenders.

Heads Up: What’s Coming & What to Catch

From Our Bookmarks