Top Stories of the Week

Ethiopia’s Better Auth, Fresh from YC Spring 2025, Secures $5M

Ethiopia Reports $2.6 Billion Balance of Payments Surplus

Ethiopia Mandates Government Offices to Accept Digital Payments from All Service Providers

Central Bank Tightens Rules, Demands Investment-Grade Rating from Foreign Banks

The Rise of Mobile Money in Ethiopia, Without the Agents

Shega Named Official Insights & Knowledge Partner for ENKOPA Summit 2025

Shega is partnering with Laurendeau & Associates as the Insights & Knowledge Partner for the ENKOPA Summit 2025.

Through this collaboration, Shega will provide clear analysis, highlight emerging trends, and share insights into Ethiopia’s Business and Innovation landscape, reinforcing evidence-based dialogue and supporting meaningful outcomes across the summit.

Pre-register now to stay ahead of announcements and secure early access:

Ethiopia’s Better Auth, Fresh from YC Spring 2025, Secures $5M

Better Auth, an Ethiopian startup building an open-source authentication framework for developers, has raised $5 million in a seed round, the largest investment raised by an Ethiopian startup in one round.

The round was led by Peak XV Partners (formerly Sequoia Capital India & SEA), with participation from Y Combinator, P1 Ventures, Chapter One, and several prominent angel investors.

The raise follows Better Auth’s participation in Y Combinator’s Spring 2025 batch, where it secured $500,000 in pre-seed funding. Less than a year old, Better Auth has gained rapid traction among developers, now exceeding 150,000 weekly downloads and racking up over 15,000 GitHub stars. Read more.

Nigeria’s Qore Technologies Sets Up Shop in Ethiopia, Betting on a Cloud-First Future

Qore Technologies, the Nigeria-based core banking infrastructure provider, has officially entered Ethiopia, bringing its cloud-native platform to local banks, MFIs, and fintechs. Read more.

Ethiopia Reports $2.6 Billion Balance of Payments Surplus

Ethiopia reported a balance of payments surplus of 2.6 billion US dollars over the past 11 months, its highest in 14 years, according to the National Bank of Ethiopia (NBE).

The surplus marks a dramatic turnaround for Ethiopia’s external sector, following a series of policy overhauls since the government began floating the birr under a managed regime last year.

ESX Sees First Broker-to-Broker Trade

The Ethiopian Securities Exchange (ESX) recorded its first broker-to-broker trade on June 26, 2025, with CBE Capital purchasing shares from Wegagen Capital, representing Wegagen Bank. This marks the initial inter-broker transaction facilitated on the exchange since its launch.

The trade reflects the ongoing development of Ethiopia’s capital markets, aiming to improve liquidity and efficiency. Brokerage fees for transactions on the ESX are set at 1.6%, as the exchange continues to establish its operational framework. Read more.

What’s on Our Mind

Last month, Uganda officially overtook Ethiopia as Africa’s top coffee exporter, shipping an estimated 6.5 million 60-kilogram bags (the standard international unit for measuring coffee trade), compared to Ethiopia’s 4.7 million. While Ethiopia still grows more overall, producing 8.25 million bags this year, Uganda has developed a more efficient system to move its coffee faster and potentially further.

On the contrary, Ethiopia’s coffee supply chain remains fragmented and analog. Nearly half of Ethiopia’s coffee produce is consumed domestically, often at prices higher than those offered internationally. Export reliability is suffering, between October 2022 and April 2023, 394 contracts were canceled, withholding 28,000 metric tons from global markets and costing Ethiopia $133 million in lost proceeds. These failures stem from a system that is neither resilient nor responsive to global market demands.

Uganda, by contrast, has spent the past decade investing in systems. Its 2017 Coffee Roadmap set ambitious targets and has doubled production. Exporters now process documentation through a national Electronic Single Window. Tools like Agriyields offer farm geo-mapping and QR-based traceability, key to meeting the EU Deforestation Regulation (EUDR), which comes into force in December 2025

By contrast, Ethiopia’s attempts to digitize exports have stumbled. CropConex, the first licensed e-commerce coffee platform, launched in 2022 has folded after a single shipment unable to overcome entrenched supply chain inefficiencies and market fragmentation. Despite a national coffee strategy and scattered reform efforts, digital infrastructure remains minimal, and awareness of EUDR requirements among smallholders is still low.

Yes, Ethiopia still grows some of the most storied beans in the world. But reputation alone is no longer enough.

Gadaa Bank Becomes Second Bank to List on Ethiopia’s Securities Exchange

Gadaa Bank has become the second bank to list on Ethiopia’s Securities Exchange, registering over 1.23M shares. It joins Wegagen as the second bank to list shares on ESX. Read more.

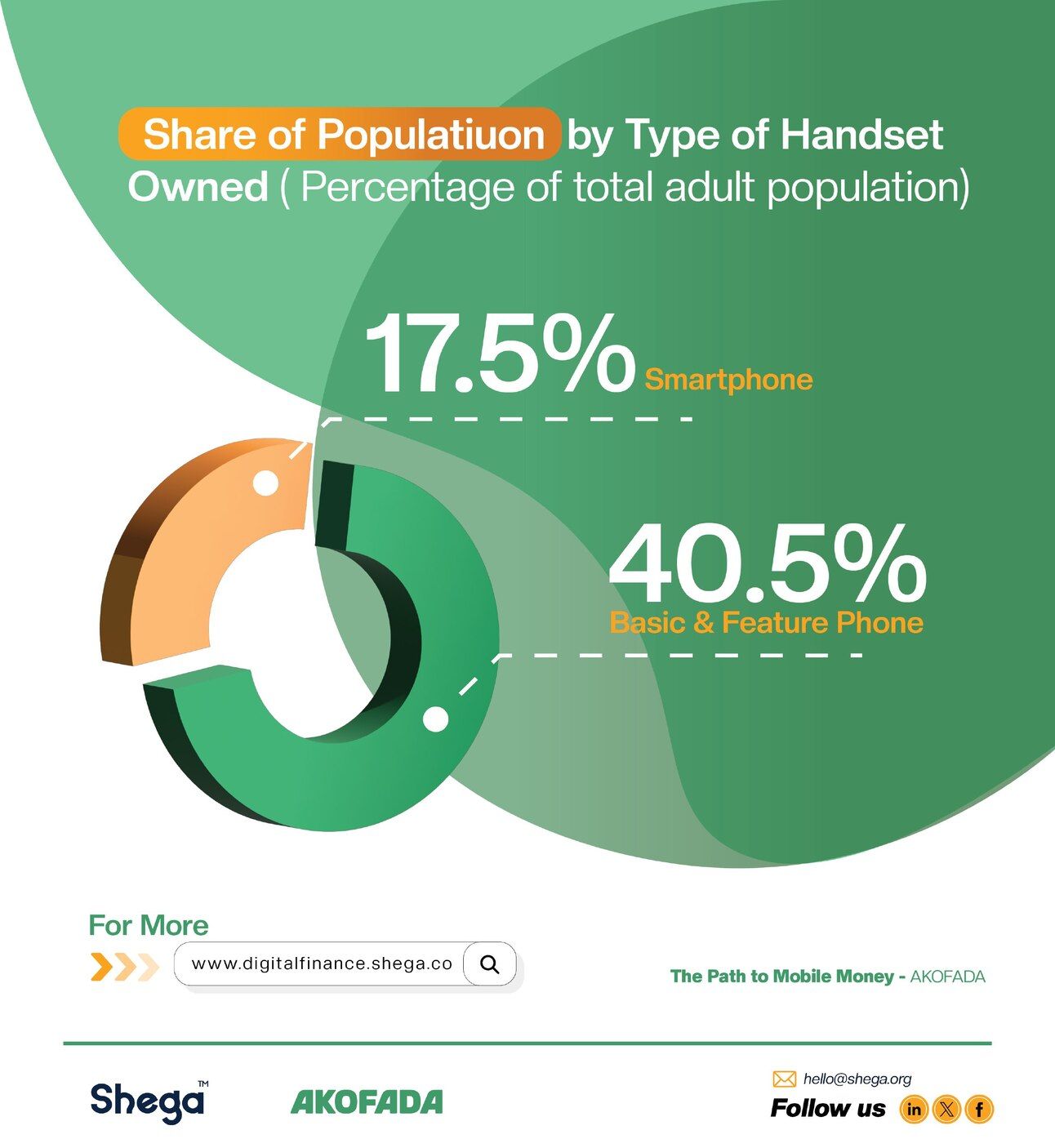

Smartphone Ownership in Ethiopia

According to the GSMA Mobile Gender Gap Report 2025, only 17.5% of Ethiopian adults own a smartphone, while 40.5% use basic or feature phones. This highlights a gap in digital access, particularly among women, with only 6% owning smartphones compared to 18% of men.

For deeper insights into the connectivity gaps that shape user behavior, explore AKOFADA’s report, “Path to Mobile Money – Users’ Journey in Ethiopia,” our initiative dedicated to expanding access to digital-finance intelligence in the country.

EFDA Launches Pharmaceutical Traceability Hub

The Ethiopian Food & Drug Authority (EFDA) has begun implementing its pharmaceutical traceability system to curb the flow of illegal medicines. Rolled out last week, the system requires all pharmaceutical exporters to Ethiopia to register with the EFDA-MVC Traceability Hub. Read more.

Ethiopia Mandates Government Offices to Accept Digital Payments from All Service Providers

Ethiopia’s Ministry of Finance has issued a sweeping new directive: all federal institutions must now accept payments from any licensed provider, from mobile wallets to debit cards.

This is a landmark regulatory update. It's a significant move that dismantles entrenched barriers in Ethiopia’s digital financial services ecosystem, which has long been dominated by state-owned giants like Ethio Telecom and the Commercial Bank of Ethiopia.

With a 90-day compliance timeline and close monitoring from the Ministry’s Inspection Department, the digital payment space may finally be opening up for fairer competition. Read more.

Ethiopia's YeneHealth Joins Google for Startups Accelerator Africa 2025 Cohort

Ethiopian healthtech startup YeneHealth has been selected for the Google for Startups Accelerator Africa program. It joins 14 other AI-driven startups tackling challenges in sectors like fintech, agritech, and healthtech. Over the next three months, the cohort will receive mentorship, training, and up to $350,000 in Google Cloud credits to support their growth. Read more.

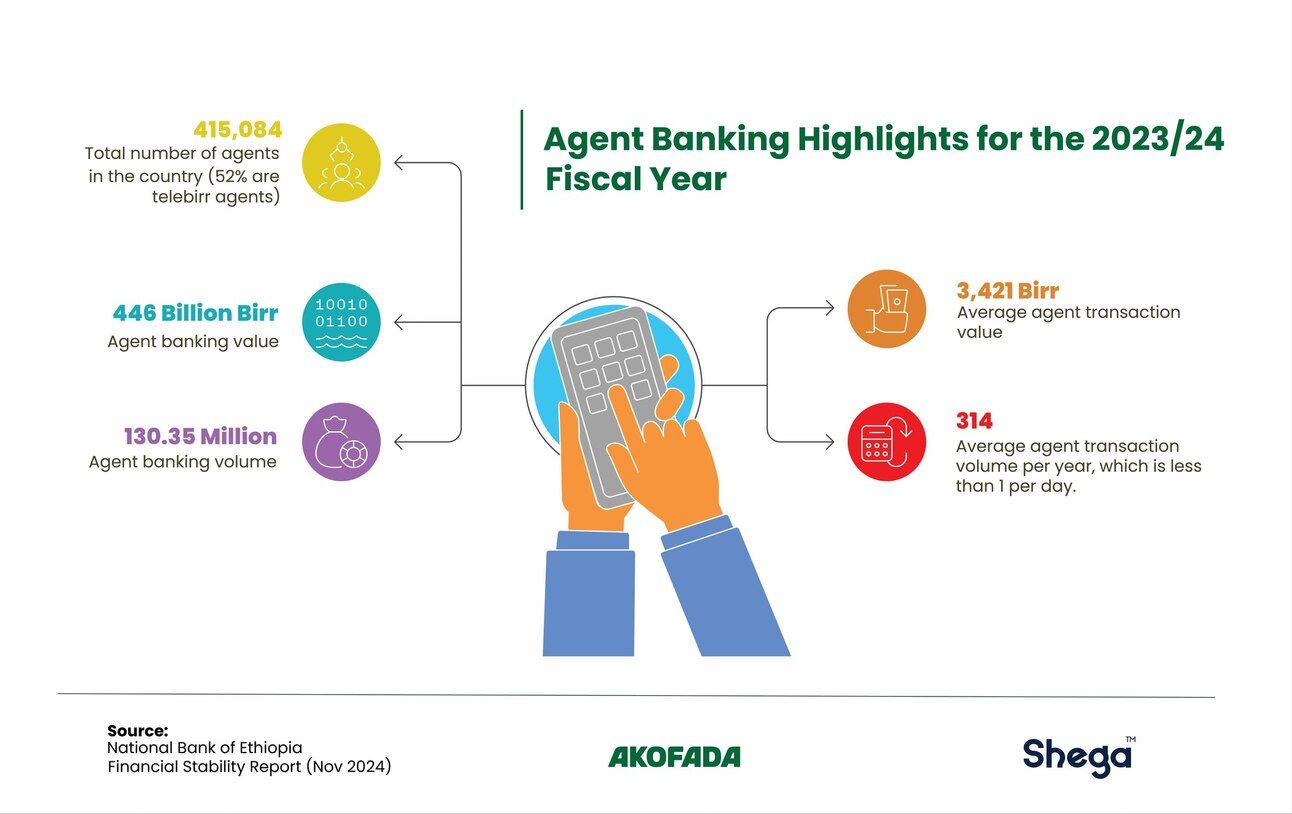

The Rise of Mobile Money in Ethiopia, Without the Agents

Mobile money usage in Ethiopia has surged, led by platforms like telebirr, but the same cannot be said for the agents meant to support the system. Despite the increase in agent registrations, many remain inactive, and those in operation are often ill-equipped.

In contrast, countries like Kenya built mobile money on the backs of robust agent networks. The lessons Ethiopia can (and can’t) take from Kenya reveal the importance of timing, context, and value proposition, and highlight why Ethiopia’s model may need to be rethought to define what agents should be in a digital-first future. Read more.

Why Most Government Websites in Ethiopia Barely Work

Ethiopia's government has digitized over 130 services, from tax filings to trading licenses, as part of its Digital Ethiopia 2025 strategy. Yet, many public platforms are plagued by dead links, outdated content, and “404" errors.

Without ongoing support and maintenance, Ethiopia’s digital gains may erode public trust and push users back to paper-based bureaucracy. Experts say the problem isn’t a lack of vision; it’s the absence of long-term maintenance, skilled staffing, and ownership after launch. Read More.

Central Bank Tightens Rules, Demands Investment-Grade Rating from Foreign Banks

The National Bank of Ethiopia (NBE) has issued a new directive requiring foreign banks to hold an investment-grade rating of at least BBB from Standard & Poor’s or Fitch, or BAA from Moody’s, as a precondition for entering the local banking sector.

The directive, which revises licensing and renewal requirements for foreign bank subsidiaries and representative offices, also sets the minimum paid-up capital at 5 billion Br for both domestic banks and foreign branches. Read more.

African Unicorns Secure Coveted Spots on TIME's 100 Most Influential Companies List

Three African tech unicorns, Flutterwave, M-KOPA, and Andela, have been featured on TIME’s 2025 list of the 100 Most Influential Companies, spotlighting the continent’s growing presence in global innovation. Read more.