Top Stories of the Week

IMF Pushes Ethiopia to Remove FX Restrictions

Ethiopia Finally Approves Long-Awaited Startup Law

BYBIT Halts Support for Ethiopian Birr on P2P Platform Amid “Regulatory Shifts”

Findex 2025 Is Out, and Ethiopia’s Progress on Financial Inclusion Is Mixed

Canada Races to Secure Investor Rights as Ethiopia Opens Key Market After Decades

Shega is an integrated information, data & intelligence solution provider. We combine trusted media, proprietary datasets, and AI-powered insight to help businesses, investors, and policymakers decode complex markets like Ethiopia and act with confidence.

Tap into our research briefs, interactive data tools, and tailored advice to turn signals into strategy, or partner with us for high-impact audience-engagement campaigns. Let’s explore what we can build together.

IMF Pushes Ethiopia to Remove FX Restrictions

The International Monetary Fund (IMF) is urging the Ethiopian government to remove exchange rate restrictions on capital account transactions, which it says bring up the cost of using the formal market.

The suggestion comes following the third review of Ethiopia’s $3.4 billion extended credit facility program, whose launch a year ago coincided with a milestone decision to shift to a market-determined foreign exchange rate.

While the Birr has depreciated significantly over the past 12 months, regulators at the National Bank of Ethiopia (NBE) have introduced restrictions on foreign exchange (FX) accounts, including increased limits for debit card withdrawals and a cap on bank fees for FX transactions. Read more.

Ethiopia’s Biggest Private Bank Partners with M-Pesa for Digital Credit, Saving Services

Awash Bank, Ethiopia’s largest private commercial bank, has entered a strategic partnership with mobile money provider M-Pesa to offer digital microcredit and savings services. The pair launched “errif be MPESA”, a digital overdraft credit service at the Bank’s headquarters early Monday morning to set off the partnership.

Currently available to all 90-day MPESA customers, it enables customers to make M-Pesa transactions when they are short on balance. This includes airtime top-ups, bundle purchases, utility payments, and merchant payments, as high as 3,000 Birr, depending on the customer's credit history. Read more.

Ethiopia Finally Approves Long-Awaited Startup Law

After half a decade of revisions and cross-ministry debates, Ethiopia has ratified its first Startup Proclamation, bringing long-awaited legal clarity, financing pathways, and innovation incentives.

It provides clear startup classifications, outlines access to public and private financing instruments, and creates pathways for incentives. This includes duty-free privileges, tax breaks, and credit risk guarantee schemes.

The challenge going forward? Implementation. For the proclamation to be more than symbolic, regulatory agencies must move swiftly to operationalize the bill’s provisions, design accessible funding mechanisms, and ensure the incentive schemes are inclusive, transparent, and startup-friendly. Read more.

World Bank Beefs up Taskforce in Ethiopia

As Ethiopia struggles to maintain the tempo of its economic reforms and avoid austerity-induced chaos, the World Bank Group has deployed a large number of teams to conduct performance evaluations and take measures on challenges being encountered in the execution of Bank-financed projects. Read more.

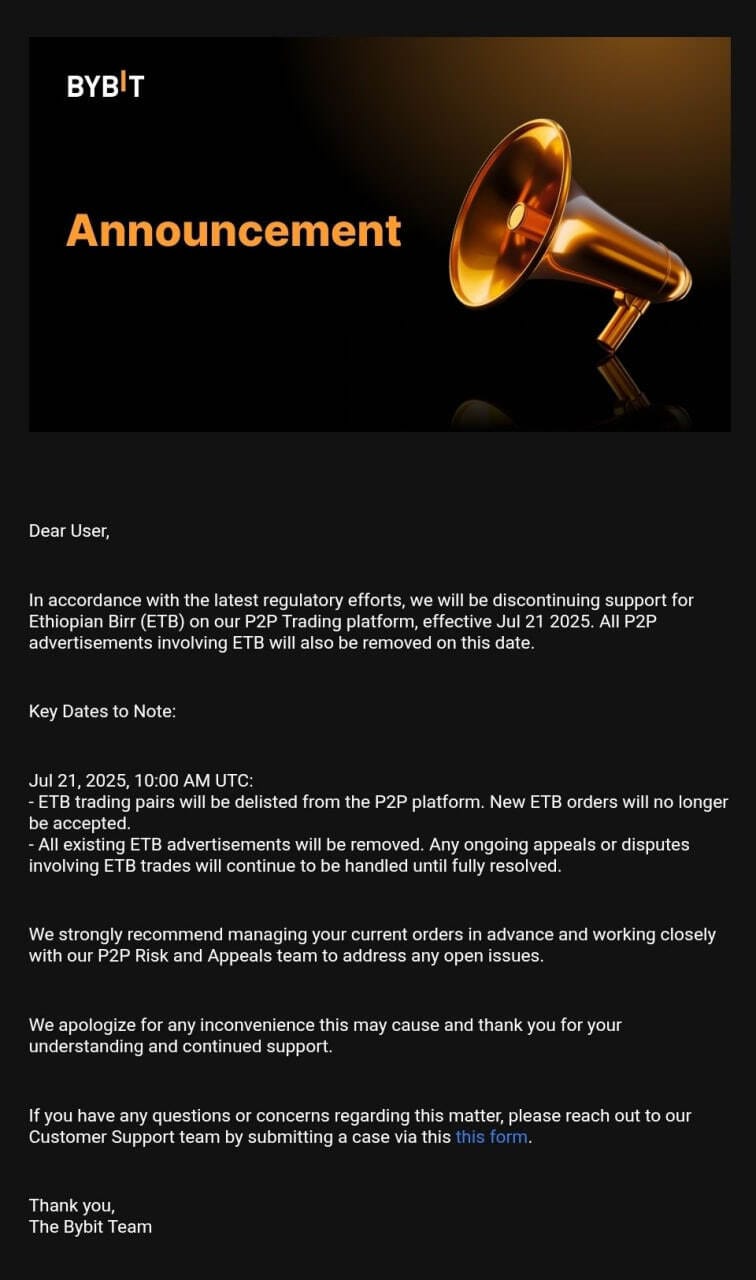

BYBIT Halts Support for Ethiopian Birr on P2P Platform Amid “Regulatory Shifts”

Global crypto exchange Bybit has announced that it is discontinuing support for the Ethiopian Birr on its peer-to-peer (P2P) trading platform, starting from Monday, July 21, 2025.

According to a statement shared with users, all ETB trading pairs and advertisements will be delisted, and no new ETB orders will be accepted beyond that point. Ongoing trades, appeals, or disputes involving ETB will still be processed until fully resolved, the company said.

The move comes amid what Bybit described as “latest regulatory efforts,” likely referring to Ethiopia’s tightening stance on digital assets as well as parallel exchange markets. Despite rising crypto interest across Africa, Ethiopia has maintained restrictions on crypto trading, including a 2022 National Bank directive banning financial institutions from facilitating crypto transactions.

What’s on Our Mind

Last week, Ethiopia ratified a contentious amendment to its income tax proclamation, part of a broader effort to boost domestic revenues and reduce reliance on external borrowing. But while the bill aims to plug gaping holes in the national budget, it has done little to quell public discontent.

At the heart of the controversy is a new monthly tax exemption threshold set at 2,000 Birr, up from a paltry 600 Birr. Though this appears generous at first glance, critics rightly point out that the revision fails to keep pace with Ethiopia’s persistent double-digit inflation. Meanwhile, earnings above 14,000 Birr now face a top marginal tax rate of 35%, with lower brackets starting at 10%.

Far more significant, however, are the quieter clauses. The flat corporate profit tax rate of 30% remains untouched, but passive incomes, interest, insurance payouts, royalties, and dividends will now be subject to a 15% levy. This change risks disincentivising savings and voluntary insurance uptake in a country already battling low financial inclusion. Content creators and freelancers have also been swept into the net, as digital income faces a new flat tax of 15%.

On paper, the logic is sound. Ethiopia’s tax-to-GDP ratio hovers around 7%, well below regional peers, suggesting untapped potential. But technocratic tweaks alone will not fix a tax regime still marred by inefficiency, opacity, and an overreliance on presumptive assessments. Without meaningful reforms to enforcement, transparency, and taxpayer trust, new levies may do more to suppress compliance than spur collection.

A broader tax base is a worthy goal. But extracting more from the same few while ignoring the structural rot of administration risks making fiscal policy both unpopular and ineffective.

SantimPay Begins Local Assembly of POS Devices in Ethiopia, Eyes Switch Operator Role

SantimPay Financial Solutions is now assembling PoS machines locally in Addis Ababa, a first-of-its-kind move in Ethiopia’s payment ecosystem.

With a daily production capacity of 3,000 units, the company plans to deploy over 23,000 machines in the near term.

Coupled with its potential partnership with UAE-based SanuPay, SantimPay looks to position itself not just as a software provider but as a full-stack player in payment hardware, gateways, and card services. Read more.

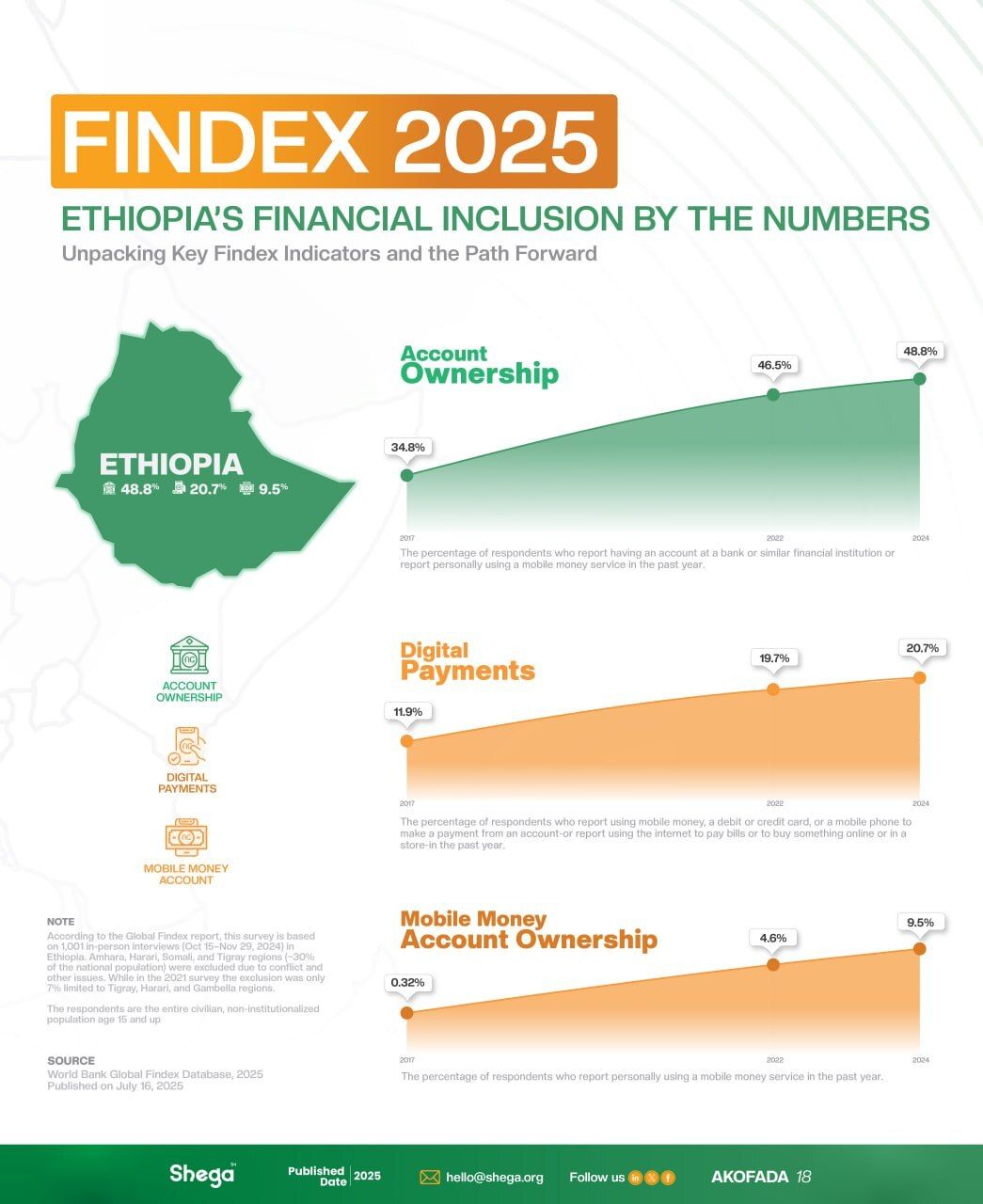

Findex 2025 Is Out, and Ethiopia’s Progress on Financial Inclusion Is Mixed

The 2025 World Bank Global Findex data is out — an authoritative and comparable dataset tracking how adults save, borrow, make payments, and manage risk across the world. And while Ethiopia has made progress, the data tells a mixed story — one of gains, gaps, and growing complexity.

Key Findings for Ethiopia: From 2021/22 to 2024

Account Ownership: Rose slightly from 46.5% to 48.8%

Mobile Money Account Ownership: Doubled from 4.6% to 9.5%

Digital Payment: Slightly increased from 19.7% to 20.7%

Despite these improvements and notable gains, the data still falls short of national aspirations. Meanwhile, according to internal National Bank data, Ethiopia’s overall financial inclusion rate is now between 62 and 64%, indicating faster momentum than demand-side data alone suggests. The latest data from the financial sector shows even more significant growth. As of March 2025, according to NBE:

Digital accounts reached 222.1M (non-unique, +16%)

Digital transaction value hit ETB 12.5 trillion (+87% YoY)

Important Context

Findex remains the global benchmark, but the 2024 survey excluded four regions (Amhara, Harari, Somali, and Tigray), leaving out ~30% of the population. This exclusion could affect the national representativeness of the results, although the exact extent is unclear.

So, what does this all mean?

Ethiopia is undeniably moving forward on digital and financial inclusion, but the pace of meaningful, equitable access is still not matching the country’s ambitions.

Bridging the gap between access and active use, especially in rural and conflict-affected regions, remains a key challenge.

And ultimately, multiple data sources — demand-side like Findex, and other bank/NBE side data — must be seen together, not in isolation

At Shega, through our project AKOFADA, we’ll continue to unpack these trends, spotlight the challenges, and push for deeper, data-informed conversations. Watch out for a deeper analysis piece on the latest Findex data from our side.

For valuable data and actionable insights on Digital Finance, visit DFS Ethiopia Hub.

A Shrub, a Startup, and an Ancient Idea: Engineer Bets on Biochar to Heal Ethiopia’s Soil

Fertilizer prices are rising as soil fertility plummets. Ethiopia’s farmers are caught in the middle. Biochar, a 2,000-year-old practice, now revived, might offer low-cost, climate-smart alternatives. Read more.

Canada Races to Secure Investor Rights as Ethiopia Opens Key Market After Decades

Canada is seeking to conclude a bilateral investment treaty with Ethiopia that would grant Canadian investors the right to sue the government in international tribunals at a time when Ethiopia is opening key sectors to foreign capital.

Talks over a Foreign Investment Protection Agreement (FIPA) topped the agenda during a visit last week by Randeep Sarai, Canada’s Secretary of State for International Development, who met Finance Minister Ahmed Shide in Addis Ababa. Read more.

The Glow-Up Is Real: Ethiopian Creators Turn Beauty Content into Cash

Ethiopia’s beauty business is getting a digital makeover, and it’s being driven by TikTok, Instagram, and entrepreneurs with ring lights and bold ideas. Read more.

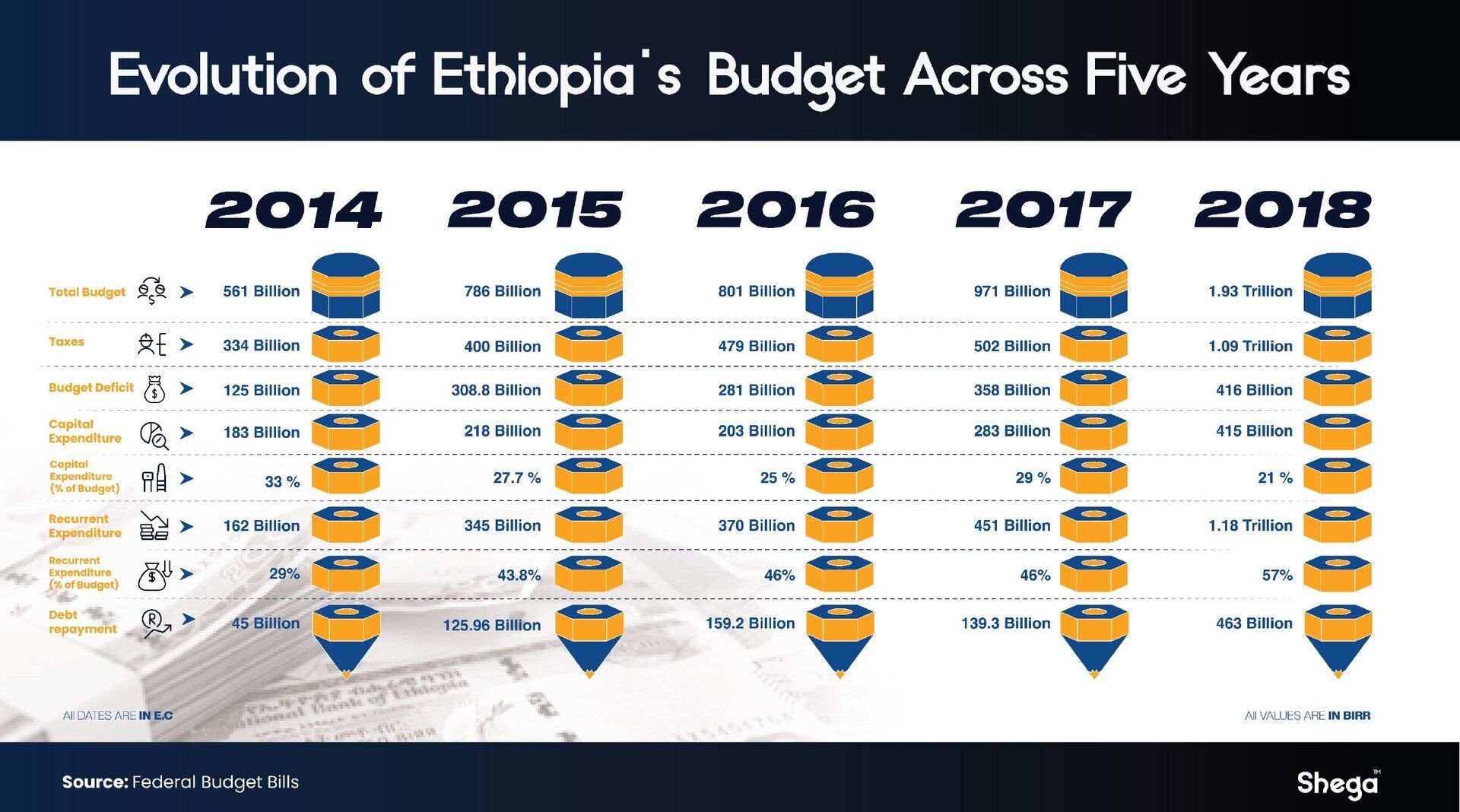

Ethiopia's parliament ratified a historic 1.93 trillion Birr federal budget two weeks back. As the first budget bill since the shift towards a relatively market-based exchange rate regime that resulted in the depreciation of the Birr, the budget has put on some nominal weight. Recurrent expenditures have continued a five-year increase, while capital allotments have maintained a steady drop in the share of the total fiscal package. Tax collection targets and debt repayment allotments are at an all-time high.

Heads Up: What’s Coming & What to Catch

From Our Bookmarks