Top Stories of the Week

Purpose Black Ethiopia Ordered to Repay Deposits with Interest

Transport, Banking, and Telecoms Drive Profit Surge at Ethiopia’s State-Owned Enterprises

CBE President Abe Sano Makes Crusade to the Middle East to Strengthen Formal Remittances

Businesses in Addis Face Shutdown by Unresolved Tax Disputes, Flawed Reforms

CBE Funds 91% of GERD; Public Covers 9%

Ethiopia’s data ecosystem holds immense potential for driving smarter decisions and innovation. From macroeconomic indicators to sectoral trends, valuable insights are published by several institutions.

These datasets are rich in substance and critical for shaping policy, investment, and innovation. Yet, accessing and aligning this information remains a challenge. Reports are scattered across portals, released in inconsistent formats, and often delayed. Navigating outdated PDFs and fragmented bulletins slows down analysis and increases the risk of error.

For decision-makers, this means spending hours reconciling mismatched figures or making decisions based on incomplete data. What we are building next is a unified intelligence platform that brings these sources together in a centralized, reliable, and searchable form to bring Ethiopia’s data together, where it can drive decisions.

Purpose Black Ethiopia Ordered to Repay Deposits with Interest

Purpose Black Ethiopia, a company initially focused on affordable groceries before pivoting to real estate, has been ordered by the Lideta Federal High Court to repay deposits with interest to a group of prospective apartment buyers.

The court ruling, which followed a six-month trial, annulled contracts worth nearly 2.3 million Birr each, providing relief to some plaintiffs amid ongoing legal and financial challenges surrounding the company's projects, including a proposed 115-story tower in Addis Ababa. Read more.

Safaricom is Quietly Adding Utility Services into M-PESA Super App

Safaricom is quietly transforming how its customers utilize digital products by integrating everyday services into its flagship M-PESA app, raising questions about the future of its long-standing self-care platform, the mySafaricom app. Read more.

Transport, Banking, and Telecoms Drive Profit Surge at Ethiopia’s State-Owned Enterprises

Ethiopia Investment Holdings, the sovereign wealth fund created to manage the country’s state-owned enterprises, last week said that 40 companies in its portfolio generated 2.05 trillion Birr in revenue in the 2024–25 fiscal year and yielded a net profit before tax of 262.7 billion birr, an 88% increase from the year before. Read more.

HahuJobs Rolls Out Free STEM Courses Backed by Canadian Partners

Minab IT Solutions, the company behind HahuJobs, an Ethiopian job-tech platform, has launched a free Learning Management Information System (LMIS) dubbed Fanos.

Designed to support Ethiopian high school students in their national exam preparation and STEM education, the platform is part of a three-year initiative backed by CAD 4 million (2.9 million USD) in funding from Global Affairs Canada and The Barrett Family Foundation. Read more.

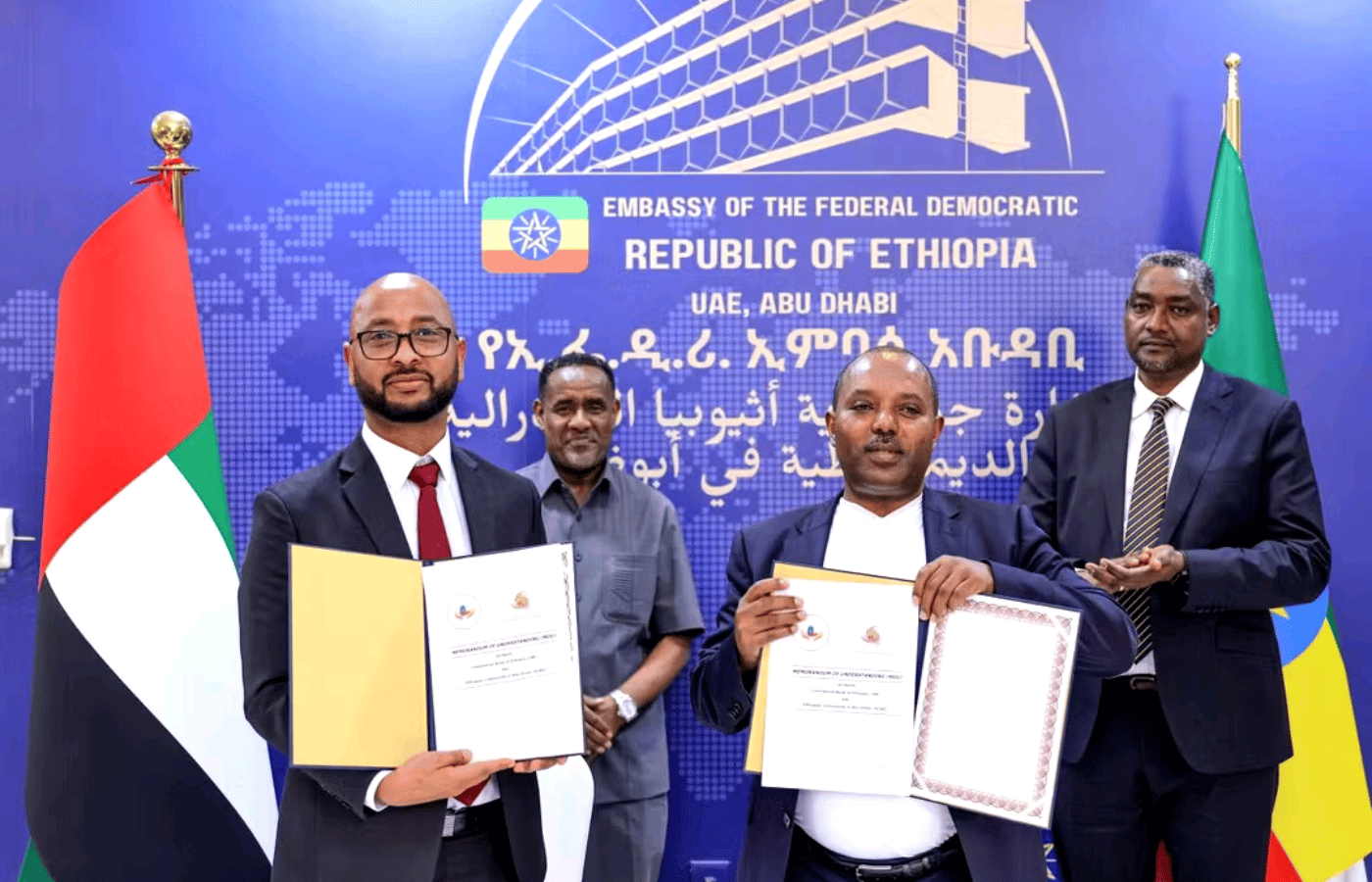

CBE President Abe Sano Makes Crusade to the Middle East to Strengthen Formal Remittances

Commercial Bank of Ethiopia (CBE) President Abe Sano led a senior delegation to Dubai last week, where he held discussions with Ethiopian diplomats, community leaders, and financial institutions.

The talks centered on expanding access to banking services, strengthening remittance flows, and supporting diaspora-led investments. During the visit, Abe and Abdulnasir Haro, Chair of the Ethiopian Community in Abu Dhabi, signed a memorandum of understanding (MoU) aimed at promoting financial literacy, expanding access to investment and trade finance, and encouraging informal transfer operators to integrate into the formal banking system.

In a separate agreement, CBE signed an MoU with Botim Company, a widely used communications and service platform in the United Arab Emirates.

The partnership seeks to expand and strengthen legal money transfer systems, providing the Ethiopian diaspora with more secure and accessible channels for remittances.

Advertisement

Looking for a reliable, smooth, and future-proof smartphone?

The Newly Launched Samsung Galaxy A26 is built to keep up with your busy life, delivering Awesome Intelligence and a premium experience without breaking the bank.

Key Features:

•Powerful AI features, including Circle to Search and an improved camera

•6.7” AMOLED Display with 120Hz Refresh Rate

•5,000mAh Battery with all-day endurance

•Up to 6 Years of Android Updates

•Budget-friendly with premium features

📍Available at these Ethio-telecom shops: Lebu, Bole Medhanialem, Bole Tele (in front of Sheger building), Churchill Enterprise, Churchill Premium, Arada

Get more out of your phone with the #GalaxyA26 and enjoy #AwesomeIntelligence every day.

What’s on Our Mind

When a Reformist Central Banker Leaves, Who Stays to Carry the Burden?

In Ethiopia’s turbulent policy landscape, the pace of change is dizzying. Laws shift, faces rotate in and out of office, and continuity feels like a luxury. The latest reminder came last week, when Mamo Mihertu, Governor of the National Bank of Ethiopia, announced his departure after just a little more than two years in the post.

Whether Mamo stepped down willingly or was nudged aside remains unclear. What is certain is that his exit is a jolt. As the central bank’s 10th governor, he was no ordinary technocrat. He had been part of the small team that negotiated Ethiopia’s four-year economic reform program with the International Monetary Fund, a deal tied to a $3.4 billion extended credit facility. That program promised structural adjustment on a scale Ethiopia had not attempted in decades: new taxes, spending restraint, and the politically perilous step of floating the birr.

The results have been bruising. For ordinary Ethiopians, the promise of a market-based exchange regime has translated into shrinking paychecks and rising costs of living. To them, Mamo was the face of an emerging neoliberal order, an order that prized interest rates, exchange stability, and inflation targets over short-term political cushioning. His departure now raises an uncomfortable question: if one of the most visible champions of reform is unwilling, or unable, to see it through, why should the public trust in its endurance?

Mamo’s tenure was defined by his battle against inflation, which had stalked the country at double-digit levels for much of the past decade. He managed to cool headline inflation to around 13 percent, just shy of his own target. But the cost was steep. Credit caps on banks choked off financing for businesses, while strict fiscal rules stalled capital projects. The cure, many businesses argue, felt as painful as the disease.

His resignation leaves more riddles than answers. Was he felled by political fatigue, by the resistance of an economy not ready for shock therapy, or by the sheer impossibility of delivering reform without social consent? Only time and perhaps history will tell.

For now, the, symbolism is undeniable. Just a year into Ethiopia’s great experiment with a floated currency, early gains already look like placebo effects against deeper structural ailments. The project was sold as transgenerational; its first champion has already jumped ship. That should give pause not only to Ethiopia’s policymakers, but also to its partners and creditors.

Economic reform is not only about numbers. It is about confidence. If the stewards of change themselves are faltering, what confidence can be expected from the public who must bear its cost?

A Young Entrepreneur’s Bid to Make Solar Power Affordable in Ethiopia

Ethiopia is set to double hydropower with the GERD, but 60M+ people still lack electricity. A young entrepreneur is betting on affordable solar to bridge the gap through local combiner boxes. Read more.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Businesses in Addis Face Shutdown by Unresolved Tax Disputes, Flawed Reforms

Businesses throughout Addis Ababa are facing a severe crisis, with many on the verge of shutdown due to ongoing disputes with the city’s tax bureau, compounded by a series of new tax policy reforms. The private sector argues these reforms are fundamentally flawed, leading to growing frustration and mistrust between business operators and tax authorities.

This predicament was brought into sharp focus during a recent high-level Public-Private Dialogue (PPD) forum, which gathered representatives from government bodies, tax officials, business chambers, and accounting professionals to discuss the theme of “Tax & Customs Reforms, Implementations & Challenges.” Read more.

Guest Contribution- Why African Ingenuity Needs Development Finance, Not Just Venture Bets:

Development finance is not charity. It’s market-making. It de-risks new ventures, builds trust, and draws in private investors. Africa’s future unicorns will come not just from venture bets. Read more.

CBE Funds 91% of GERD; Public Covers 9%

Ethiopian Electric Power (EEP) announced that the Commercial Bank of Ethiopia has financed 223 billion birr of the 233 billion birr spent constructing the Grand Ethiopian Renaissance Dam (GERD), accounting for 91 percent of the total cost.

Moges Mekonnen, EEP’s communications director, announced this during a press conference this morning. Moges said that the remaining 10 billion birr, or 9 percent, was raised from public contributions, including 18.9 billion birr from bond sales, 1.6 billion birr from the Ethiopian diaspora, and 3.2 billion birr in donations. Read more.

Heads Up: What’s Coming & What to Catch

From Our Bookmarks